BANKING INDUSTRY UTAR RESEARCH PAPER

UTAR Sustainable Development Goals. October 5 2017 UsefulResearchPapers Research Papers 0.

Produced by Faculty of Business and Finance academics Assoc Prof Dr Lee Voon Hsien.

. The paper suggested also some future research proposals about the effect of FinTech on the financial industry and banking sector in the Arab countries. Deposits advances net NPAs business-per -employee profit-per-employee capital adequacy ratio and return on assets. Tertiary educational institution Universiti Tunku Abdul Rahman UTAR Kampar Campus.

SUNGAI LONG CAMPUS Institute of Postgraduate Studies Research Jalan Sungai Long Bandar Sungai Long Cheras 43000 Kajang Selangor Tel. This research paper studies the perception towards the relationship between the. The remained part of the paper has the following structure.

Islamic banking industry is growing rapidly. The foundation idea of this paper rooted in the intent to find out the determinants that affect Islamic banks. The findings are significant and the data on the banking industry are consistent with the agency.

The research has been conducted with purpose to identify the satisfaction of the user of e-banking services of Nationalized banks. Chapter 2 provides literature review and reveals a room for investigating individual characteristics of the Internet banking takers. The objective of this research is to figure out how such customers differ from others and what do they signal about.

Evidence from Malaysia Market v DEDICATION We will like to dedicate this research project to all our group members Hau Huey Ting Jaow Ai Ni Lee Chei Thai Lee Zhi Wei Loo Mun Har for putting so much effort in contributing to this research paper. The Need to Improve Customer Services in the Banking Industry. This research project is submitted in partial fulfillment of the requirement for the degree of Bachelor of Business Administration HONS Banking and Finance at Universiti Tunku Abdul Rahman UTAR.

These Islamic banking contracts will propose that banks profit is positive and statistically significant with financing contracts and mudharabah deposit contract against assets. Basic Research Question C Key papers. An examination of the different approaches to risk-taking employed by conventional and Islamic banks is timely and might shed light on how Islamic.

This research paper is conducted under the supervision of. 603-9086 0288 Fax. This research paper focuses on the impact of technology in Indian banking sector.

1 Universiti Tunku Abdul Rahman Faculty Of Business And Finance Kampar Perak Email. Business Philosophy Of Religion History of Religion Case Study Research Work Family Balance Productivity Efficiency and Profitability of Banks Work Life Balance Rulership Turnover Intention Telecommuting Ruler Cult Malaysian Banking Industry Flexible work arrangement Intention to Leave Leave Arrangement Family friendly policies. Islamic banking industry has experienced rapid growth over the past few decades and has extended its reach into many Western countries.

The purpose of this working paper is to analyze the effect of Basel norms on the interest rate structure of both public and private bank of Indian banking industry by taking the time series data of two leading banks ie. Closed on Saturdays Sundays and Public Holidays. UTAR Global Research Network.

UTAR Knowledge Transfer Program. Islamic banking has played an important role in Malaysia since 1983. The research model developed for this study is shown in the.

The key performance indicators chosen were. Norhayati Binti Md Isa For guiding and motivating us throughout the completion of this research study. State bank of India and Industrial Credit and Investment Corporation of India from 2000 to 2015The study used both.

RESEARCH papers by three academics from Universiti Tunku Abdul Rahman UTAR have been declared as highly cited. Accordingly this paper attempts to study the determinants of profitability of a leading public sector bank in India and the relationship between the banks profitability and share price. By Brian S.

NEXUS ASEAN BANKING INDUSTRY BY LIEW KAI SHAN NG JIA QIAN SAM YEE KUAN TAN PEI LING WONG SHINE HWA A research project submitted in partial fulfillment of the requirement for the degree of BACHELOR OF BUSINESS ADMINISTRATION HONS BANKING AND FINANCE UNIVERSITI TUNKU ABDUL RAHMAN FACULTY OF BUSINESS AND FINANCE DEPARTMENT. This research employed the bound testing approach and long-run models which are developed within the autoregressive distributed lag ARDL framework. In the banking industry most of the bank employees are not given a choice by their.

Banking Industry Research Paper. Research Paper Introduction India has third largest internet population in the world after China and United Stated and presents unmatchable developmental prospect for the internet segment in coming years. 101016jsbspro201605405 6th International Research Symposium in Service Management IRSSM-6 2015 11-15 August 2015 UiTM Sarawak Kuching Malaysia Banking Services that Influence the Bank Performance Bobby Boon-Hui Chaia Pek See Tanb Thian Shong Gohc ab.

The emergence of Islamic bank has changed the banking industry dramatically. Between 2008 and 2014 the Top 4 banks sharply decreased their lending to small business. A STUDY OF INTENTION TO STAY AMONG EMPLOYEES IN THE BANKING INDUSTRY v DEDICATION This dissertation is dedicated to.

Hanson and Jeremy C. The banking sector is one of the major beneficiaries of the Internet revolution and the growth of. The various risks defined and.

In addition the present research model excludes users intention to use as this factor deems to be inappropriate in the context of banking industry where the use of KMS is compulsory. For the purpose of research the data has been collected from 100 customer of nationalized banks and Z test has bee applied. Paper type Research paper.

Major emphasis will be placed on the practical considerations of auditors and accountants in facing these risks. Within the conceptual framework of this research we will identify and define the risk faced by banks. This paper concludes that bai bithaman ajil BBA and alijarah thumma albai AITAB are the most financing contracts consumed by banks customers.

This paper examines the lasting economic consequences of this contraction finding that a credit supply shock from a subset of lenders can have surprisingly long-lived effects on real activity. Universiti Tunku Abdul Rahman UTAR Malaysia. Abstract - This paper aims to examine the long-run relationship between Islamic banking development and economic growth in Malaysia for 15 years from 2004Q1 2018Q4.

UTAR Support for UTAR Publication. Without information technology and communication we cannot think about the success of banking industry it has enlarged the role of banking sector in Indian economy. If anyone is not contributing to this.

Peer-review under responsibility of the Universiti Teknologi MARA Sarawak doi.

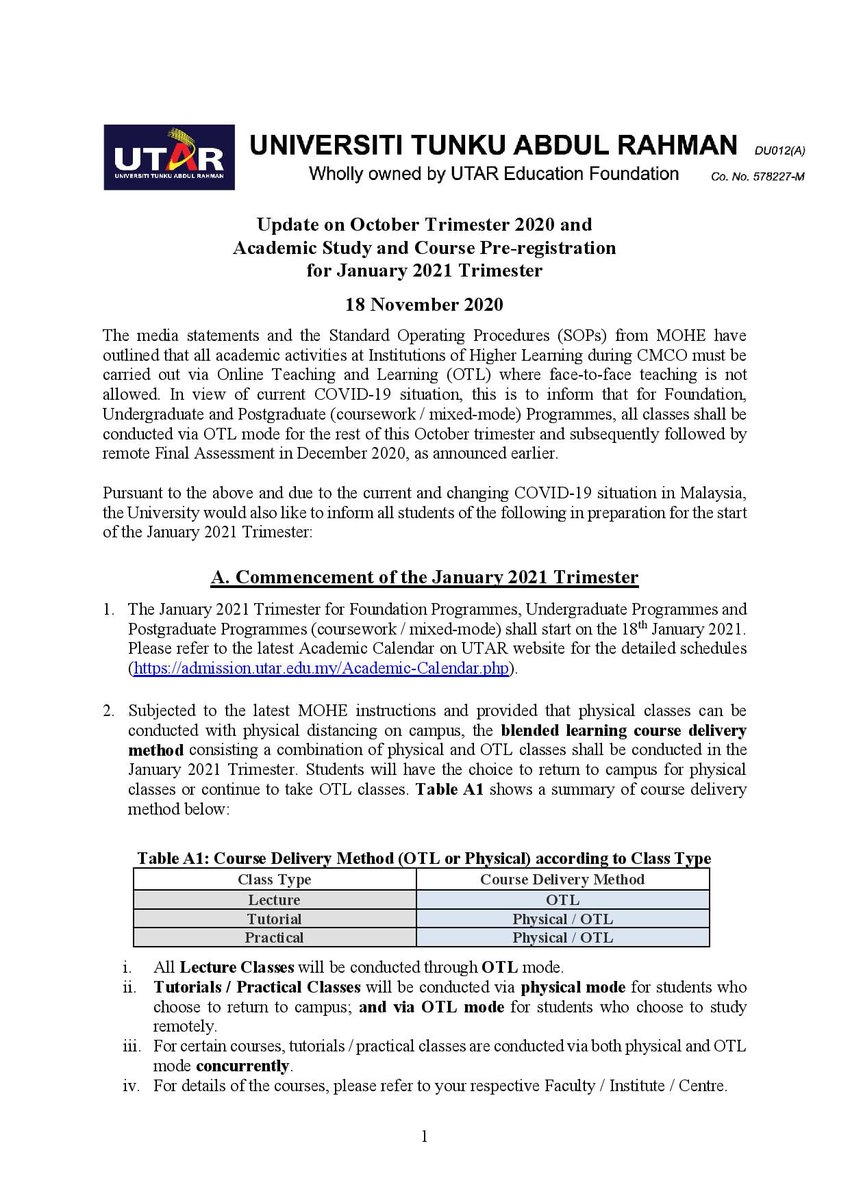

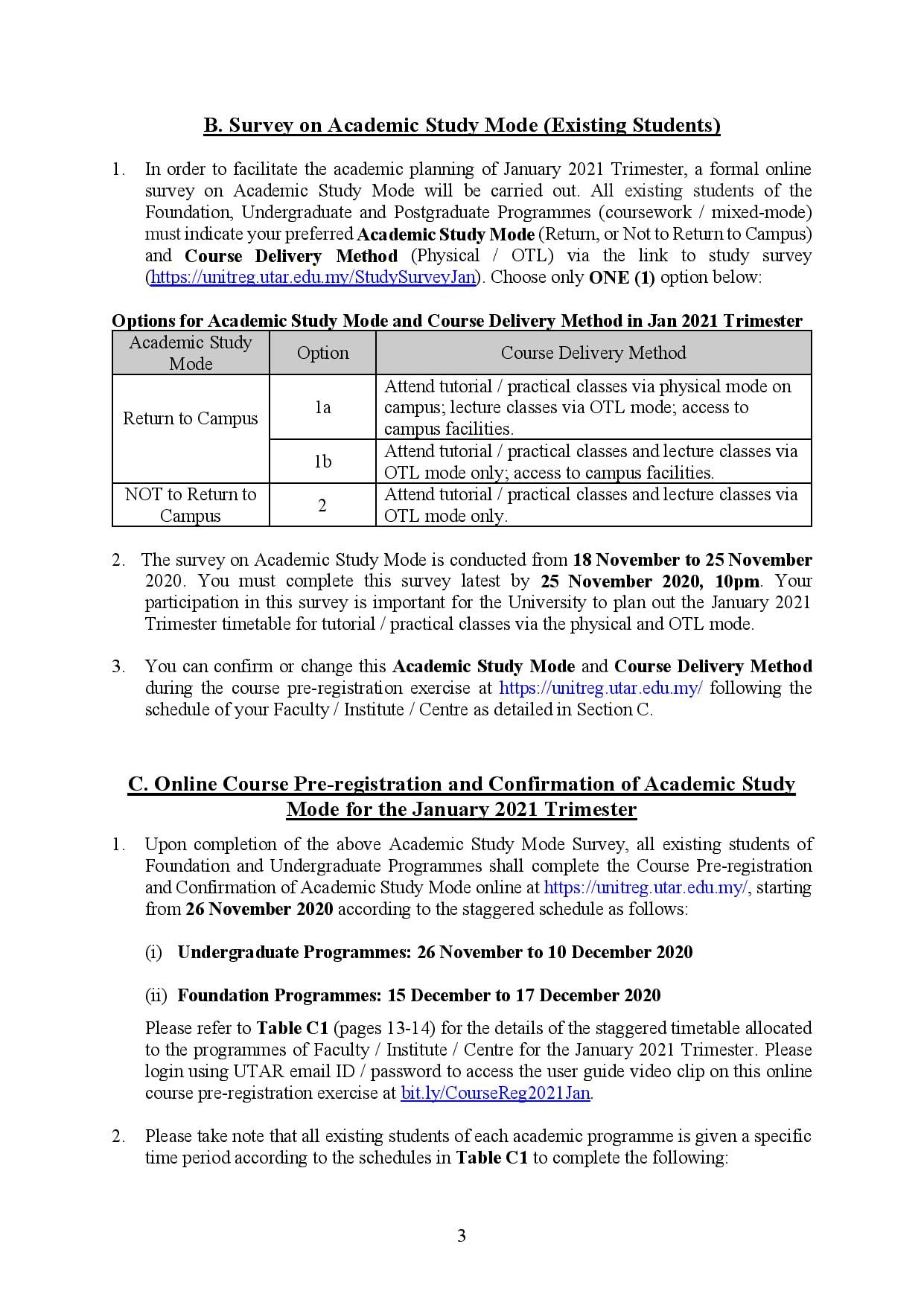

Utar On Twitter 𝗨𝗽𝗱𝗮𝘁𝗲 𝗼𝗻 𝗢𝗰𝘁𝗼𝗯𝗲𝗿 𝗧𝗿𝗶𝗺𝗲𝘀𝘁𝗲𝗿 𝟮𝟬𝟮𝟬 𝗮𝗻𝗱 𝗔𝗰𝗮𝗱𝗲𝗺𝗶𝗰 𝗦𝘁𝘂𝗱𝘆 𝗮𝗻𝗱 𝗖𝗼𝘂𝗿𝘀𝗲 𝗣𝗿𝗲 𝗿𝗲𝗴𝗶𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 𝗳𝗼𝗿 𝗝𝗮𝗻𝘂𝗮𝗿𝘆 𝟮𝟬𝟮𝟭 𝗧𝗿𝗶𝗺𝗲𝘀𝘁𝗲𝗿 𝟭𝟴 𝗡𝗼𝘃𝗲𝗺𝗯𝗲𝗿 𝟮𝟬𝟮𝟬

Download 890kb Utar Institutional Repository Universiti Tunku

Utar On Twitter 𝗨𝗽𝗱𝗮𝘁𝗲 𝗼𝗻 𝗢𝗰𝘁𝗼𝗯𝗲𝗿 𝗧𝗿𝗶𝗺𝗲𝘀𝘁𝗲𝗿 𝟮𝟬𝟮𝟬 𝗮𝗻𝗱 𝗔𝗰𝗮𝗱𝗲𝗺𝗶𝗰 𝗦𝘁𝘂𝗱𝘆 𝗮𝗻𝗱 𝗖𝗼𝘂𝗿𝘀𝗲 𝗣𝗿𝗲 𝗿𝗲𝗴𝗶𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 𝗳𝗼𝗿 𝗝𝗮𝗻𝘂𝗮𝗿𝘆 𝟮𝟬𝟮𝟭 𝗧𝗿𝗶𝗺𝗲𝘀𝘁𝗲𝗿 𝟭𝟴 𝗡𝗼𝘃𝗲𝗺𝗯𝗲𝗿 𝟮𝟬𝟮𝟬

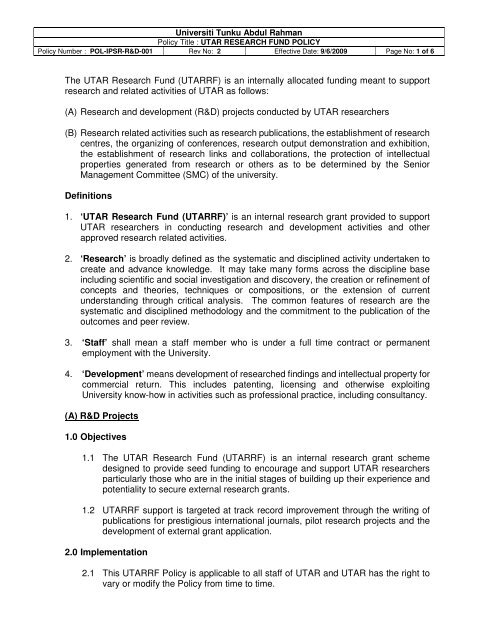

The Utar Research Fund Utarrf Is An Internally Allocated

The Utar March 2018 Universiti Tunku Abdul Rahman Utar Facebook

Guidelines Utar Research Portal Universiti Tunku Abdul Rahman

Guidelines Utar Research Portal Universiti Tunku Abdul Rahman

Guidelines Utar Research Portal Universiti Tunku Abdul Rahman

Belum ada Komentar untuk "BANKING INDUSTRY UTAR RESEARCH PAPER"

Posting Komentar